There are a lot of parallels in the two companies’ growth trajectories

Unexpectedly, vidia and Amazon Web Services—Amazon’s profitable cloud division—have a lot in common. To begin with, their main ventures were the result of a fortunate coincidence. Realising it could offer the internal services it had developed for itself in-house—memory, computation, and storage—was what Amazon was doing. For Nvidia, it was the GPU’s suitability for handling AI workloads despite being designed primarily for gaming.

Eventually, as a result, revenue in recent quarters has grown explosively. With triple-digit growth, Nvidia’s sales increased from $7.1 billion in Q1 2024 to $22.1 billion in Q4 2024. Even while the company’s data centre business accounted for the great majority of that increase, it’s still an impressive trend.

Even while it never went through such a sharp development surge, Amazon has continuously contributed significantly to the e-commerce behemoth’s revenue, and both businesses have benefited from first market advantage. However, as Google and Microsoft entered the market over time, they became the Big Three cloud vendors. It is anticipated that other chip manufacturers will eventually start to obtain a sizeable market share as well, even though the revenue pie will continue to rise over the next years.

It’s obvious that both businesses were in the right place at the right moment. Around 2010, mobile and web apps started to gain popularity, and the cloud offered the on-demand resources. Businesses quickly realised that developing apps or migrating workloads to the cloud was more advantageous than maintaining their own data centres. Similarly, the growth of GPU usage to handle these tasks coincided with the rise of AI over the past ten years, and huge language models more recently.

With an annual revenue approaching $100 billion, AWS has become a hugely wealthy enterprise over the years. Even if it were to operate independently of Amazon, it would still be a very successful corporation. But even as Nvidia’s growth soars, AWS’s has started to slack off. A portion of it is due to the law of huge numbers, which will also eventually have an impact on Nvidia.

Whether Nvidia can maintain this growth and become into a long-term revenue powerhouse similar to what Amazon’s AWS has become is the question. Nvidia does have alternative businesses in case the GPU market tightens up, but these are considerably smaller income generators and are developing far more slowly than the GPU data centre business is now. This chart illustrates this.

The financial prospects in the short term

Nvida’s revenue growth has been phenomenal in the last few quarters, as the accompanying chart shows. And Wall Street experts and Nvidia both predict that it will go on.

Nvidia informed investors in its most recent earnings report for the fourth quarter of its fiscal 2024—that is, the three months ending January 31, 2024—that it expects to generate $24 billion in revenue in this quarter (Q1 FY25). In the first quarter, Nvidia anticipates growth of about 234% over the same period last year.

The financial prospects in the short term

Nvida’s revenue growth has been phenomenal in the last few quarters, as the accompanying chart shows. And Wall Street experts and Nvidia both predict that it will go on.

Nvidia informed investors in its most recent earnings report for the fourth quarter of its fiscal 2024—that is, the three months ending January 31, 2024—that it expects to generate $24 billion in revenue in this quarter (Q1 FY25). In the first quarter, Nvidia anticipates growth of about 234% over the same period last year.

For instance, experts project that Nvidia will bring in $110.5 billion in sales for its current fiscal year, an increase of little more than 81% over the same period last year. That represents a significant decline from the 126% gain it reported in its most recent fiscal year, 2024.

In response, we query: So what? It is anticipated that Nvidia will maintain its sales growth over the $100 billion annual run rate threshold for the next few quarters. This is remarkable considering that the company’s total revenues a year ago were only $7.19 billion.

In summary, experts and Nvidia, to a lesser extent, anticipate enormous growth for the company in the near future, even though some of the startlingly high revenue growth numbers will decline this year. What transpires over a marginally longer time horizon is unknown.

Momentum ahead

For Nvidia, artificial intelligence (AI) appears to be the gift that keeps on giving over the next few years, despite increasing competition from AMD, Intel, and other chipmakers. Similar to AWS, Nvidia will eventually face more fierce competition, but since it currently holds such a large market share, it can afford to give up some ground.

When considering it exclusively at the chip level rather than boards or other adjacent levels, IDC demonstrates Nvidia’s stronghold:

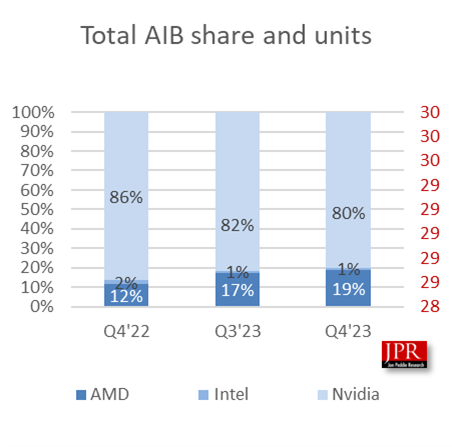

While Nvidia continues to lead the GPU industry, AMD is starting to gain ground at the board level based on these market share figures from Jon Peddie Research (JPR), a company that studies the GPU market:

C According to JPR researcher Robert Dow, some of these variations are related to the launch dates of new items. “NVIDIA has been in a dominant position for years, and that will continue, but AMD gains percentage points here and there depending on cycles in the market — when new cards are introduced — and inventory levels,” Dow told TechCrunch.

Even while patterns are subject to change, Shane Rau, an IDC analyst that tracks the silicon business, believes that supremacy will persist. The marketplaces in which Nvidia operates are large and growing, there are trends and countertrends, and growth will continue for at least the next five years, according to Rau.

That is partially due to Nvidia’s sales of products other than the chip itself. On one of their own supercomputers, they will sell you boards, systems, software, services, and time. Nvidia is therefore involved in all of those large and expanding markets,” he stated.

Nvidia is viewed as an unstoppable force by some, though. Longtime cloud expert and author David Linthicum claims that GPUs aren’t always necessary, and businesses are starting to realise this. They claim to require GPUs. They don’t need them when I take a look at it and do some back of the envelope maths. CPUs operate flawlessly,” he declared.

He believes that when this takes place, Nvidia will start to slow down and the competition’s grasp on the market will weaken. “Over the next few years, I believe Nvidia will become a less competitive participant. And since there are too many alternatives being developed, we will witness that.

As businesses increase their use of Nvidia products for AI use cases, Rau claims that other suppliers will also gain. Future developments, in my opinion, will result in expanding markets that will benefit Nvidia. However, other businesses that ride those tailwinds will also profit greatly from artificial intelligence.

It’s also feasible that a disruptive force would emerge, which would be advantageous in preventing one business from gaining an excessive amount of dominance. You practically hope for disruption since that’s how capitalism and markets function best, don’t you? When one supplier acquires an early advantage, others follow, and the market expands. Established companies are eventually overtaken by more effective ways to accomplish the same task in their own market or in nearby markets that are encroaching on them, according to Rau.

In reality, we are starting to witness that at Amazon as Microsoft advances in AI thanks to its partnership with OpenAI, forcing Amazon to catch up. Regardless of Nvidia’s future course, it is currently securely in control, generating enormous profits, controlling a rapidly expanding market, and having nearly everything work in its favour. However, that does not mean that things will stay this way or that future pressure from competitors won’t increase.